“I cannot figure out the value of my data!” Exactly! Art or science, theoretical. Few have connected the value of data to the value of a business or shown causality of quantitative improvement in Data Quality (DQ) to a measurable increase in business outcomes. If a race car team has a new motor with more output than the previous generation (or competitors), should they use the same fuel or improve the fuel quality to maximize the output of the new motor? The answer is, it depends on what the motor requires; that may determine whether they win races, or not.

Public companies show “Plant, Property and Equipment” as a line item on their balance sheets, but nowhere is there a line item for data (as an asset). Companies count some IT investments as CapEx and bundle that into the balance sheet somewhere, or as OpEx and count it as COGS, but nowhere is there a calculation for “1 million material master records” or “1 million customer records” and a value. If there was a value, what would you put? There might be “goodwill” or a line item for “intangible.” How does one calculate the value of the data itself, or whether it is an asset or liability on the operational excellence (OX) or customer experience (CX) of your business?

Let’s say those 1M records are worth on paper $1M because the cost is $1 each to create. Let’s assume collectively that data, combined with your people, process, and technology, creates $100M in operating margin every year for your business. How would you isolate the value derived from only the data? Let’s presume it is $10M. What is the data ROI? What is the data ROI over five (5) years considering growth? How do you maintain the data? How do you monitor and remediate the DQ? Maybe it costs about $1M to keep that data at perfect DQ (however you measure it). Let’s compare it with the fixed asset.

Consider an asset (a machine) worth $1M that creates a similar $10M in value for the business every year. This asset consumes maintenance and operational costs of $1M per year. The $10M in data is similar in terms of financial performance. One asset “type” is on the Balance Sheet, and the other is likely not. Data itself is often created and maintained (maybe) in “hidden content factories” as a side effect of doing business. Usually, this activity isn’t funded directly, so that hidden cost comes out of selling, general, and administrative (SG&A). Do you know how much SG&A is related to DQ at your company?

Like any asset, data must be maintained. Time to think about investing in that 1M data records, like upgrading, retrofitting, or maintaining a piece of Equipment – is not tracked, and the data has no residual value (depending on your business model). Data also is not depreciated. But data does go bad, it churns and must be updated. When new data is created, it must be done according to standards and rules and should meet or exceed your DQ requirements if it doesn’t, it might act more like a liability than an asset.

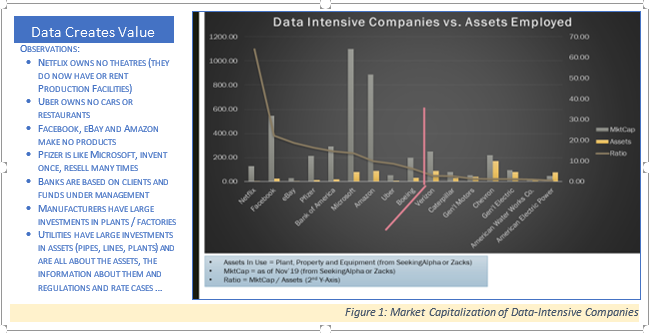

For comparison, take asset-intensive companies versus data-intensive companies, like Facebook, Amazon, and eBay; they have a lot of data and little to no fixed assets, but the market rewards them with huge market capitalizations. Data-intensive companies have the unique ability in their business models to create huge returns or at least the promise of huge returns. Figure-1 illustrates this concept.

What is the value of the data? (the graphic illustrates how some companies leverage data to create value, as shown by taking market capitalization and dividing by assets in use; cash reserves and other assets are out of the equation) In general, it seems, asset-intensive companies do not leverage data as a primary competitive advantage as the non-asset-intensive companies do. This could be a key to re-invigorating and a driver for business transformation.

In another blog post, we’ll attempt to derive “value of data” for asset-intensive companies and try to trend high performers who leverage their data better than others. We believe data-driven companies, regardless of industry, are nearly always going to be the outperformers. In general, it seems, many asset-intensive companies do not (yet) leverage data as a primary competitive advantage like the non-asset-intensive companies do.

Utopia is here to help – maybe together, we can bring some ideas and thought leadership to help you with your business transformation. Contact the Utopia Strategic Value Management (SVM) team at SVM@UtopiaInc.com to learn more. Thank you.